|

Apr 21 2014, 10:09 AM Apr 21 2014, 10:09 AM

Post

#1

|

|

Spends WAY too much time at CBTL       Group: Admin Posts: 16,421 Joined: 8-December 06 From: Michigan City, IN Member No.: 2 |

|

Apr 21 2014, 12:07 PM Apr 21 2014, 12:07 PM

Post

#2

|

|

Member    Group: Members Posts: 93 Joined: 15-February 14 Member No.: 1,319 |

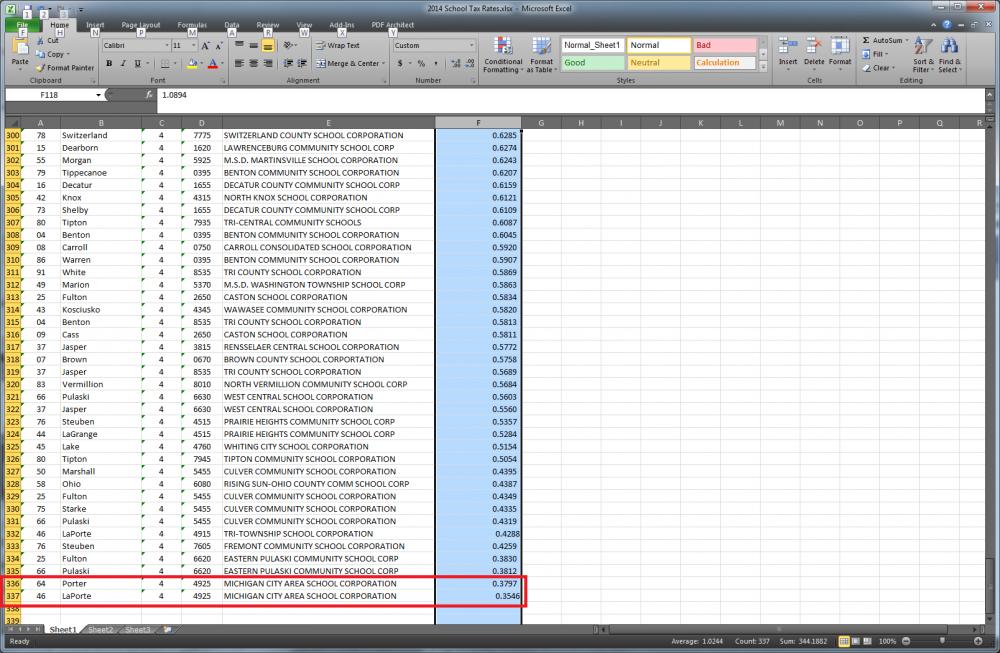

The Michigan City Area Schools are LAST in the entire State of Indiana for their local tax rate which goes to the schools. NO ONE in the entire state pays a lower school tax rate than the residents of the MCAS.  No one, especially me, likes to pay taxes. However, like the old saying says, "you get what you pay for." I went all through the Michigan City School System and it doesn't hold a candle to what my children get now where I live in Western Pennsylvania. It is more expensive here, but it is measurably better. It is up to the voters and I think that the demographics of the city have a lot to do with it. I am a "boomer" and when I was in the MC schools they were bursting at the seams. One way stairways, overcrowded classrooms and multiple lunch hours. I was at Elston for the last year prior to and just after the opening of Rogers. I think that was 72(?). I imagine the demographics of MC are a lot older now. There are fewer kids, lower enrollment, a lower tax base, and a lot of resistance to tax increases. That's not necessarily a good thing, it's just a fact. That's my $.02 on the matter. |

Apr 21 2014, 06:09 PM Apr 21 2014, 06:09 PM

Post

#3

|

|

|

Member    Group: Members Posts: 80 Joined: 25-September 13 Member No.: 1,288 |

My first impression is "What an odd bunch of democrats you have over there!"

While I do think and have always thought MC citizens could pay a lot more for its schools, I think a little more analysis of this list is required. One primary reason for some school systems being that low on the list are due to the composition of its tax base. For example - Switzerland County Schools #300 and Rising Sun #328 (in same county) are virtually subsidized by its casino revenues down there (you can do that when no one lives there!). Most of Whiting's #325 tax base is composed of BP. Tipton County Schools #328 has a large commercial base, its employees primarily live in Delaware county (Muncie) and a large wealthy farm base. Benton County Schools #308 and Carroll County Schools #309 have some of the largest and wealthiest farmers in Indiana. Tri County Schools (Monticello) #311 has a very large commercial base in proportion to its population - majority of the employees in that county live in Tippecanoe county (Lafayette). Renssellaer Schools #317 also has high commercial base in proportion to its population and lots big wealthy farmers. The wealthy farmers have capped tax rates at 2% and 3% for their farm land, buildings and equipment as opposed to 1% caps on large residential areas. Large commercial basis permits rates up to 3%. Though, most of the areas I listed above are not near the max caps for combined rates. I am not as familiar with MC's tax base as I am with these others, but I would think NIPSCO would pay a healthy chunk and many of the homes on Lake Shore Drive are second homes subject to 3% cap. It would also be interesting to compare this list to poverty rates, high school graduation rates, and number of college bound students. |

Apr 22 2014, 07:21 AM Apr 22 2014, 07:21 AM

Post

#4

|

|

|

Advanced Member     Group: Members Posts: 321 Joined: 24-February 10 Member No.: 999 |

Groucho, "You get what you pay for", really? What about you want to continue to receive without paying for anything. The school system was fine years ago with more schools and I assume still a low tax base. The real problem no one wants to address is the community has changed drastically. Jobs have left the area and are not coming back. Throwing more money at the problem will not correct the problems, it will only mask the problems for a few more years. A declining popluation doesn't require as many schools as we currently have. Re-purpose, close, knock down, moth ball, you choose the word but a few schools need to be shut down. Class size will not be drastically increased. Stop beating a dead horse. The voters spoke and they don't want their taxes increased, they expect the administration and the school board to be held accountable. Get their finances in line and do the job they signed up for.

|

|

2 User(s) are reading this topic (2 Guests and 0 Anonymous Users)

0 Members:

| Lo-Fi Version | Time is now: 19th April 2024 - 03:58 PM |

Skin Designed By: neo at www.neonetweb.com

Invision Power Board

v2.1.7 © 2024 IPS, Inc.